|

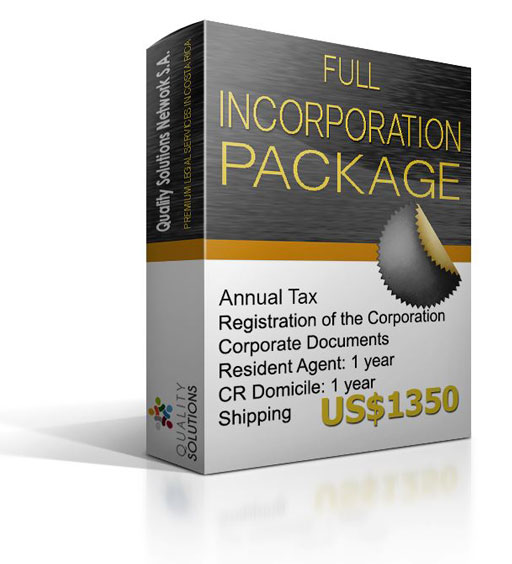

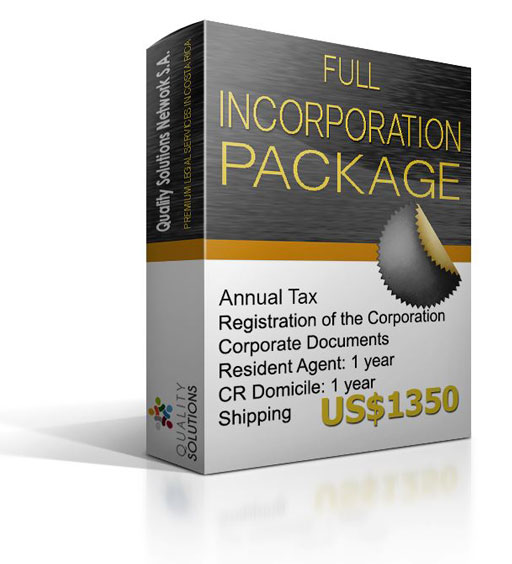

Full Incorporation Package in Costa Rica:

The Full Incorporation Package Includes:

NOW US$1350

- Annual Tax: It must be paid during January of each year. Included for the year of incorporation.

- Resident Agent (Costa Rican Attorney): 1 year

- Costa Rican Domicile: 1 year

- Annual Tax Filing: 1 year

- Articles of

Incorporation.

- Copy of the Articles of Incorporation with Apostille.

- Certified translation to English of the Articles of Incorporation.

- Apostilled Extract from the Public Registry with the registration information

and the current representatives of the corporation (serves as

certificate of incumbency, certificate of good standing and

certificate of incorporation).

- Certified translation to English of the Extract.

- Share certificates issued per your instructions.

- Legal Books.

- First Minutes of the Board in the Legal Books.

- Shipping

There are different types of corporations in Costa Rica, so here we

provide a brief description of the most common used ones. Also to

incorporate in Costa Rica you have to take into account the requirements

involved in the incorporation of a Costa Rican Corporation (S.A.)

or a Limited Liability Company (L.L.C. or L.T.D.A.):

Basic Incorporation Package:

Total Cost of Company Creation (no extra fee will

be charged except for additional services): USD$ 700+Shipping

Shipping: (Depends on the method, country, and place of delivery).

The Basic Incorporation Package Includes:

US$700+Shipping

- Annual Tax: It must be paid during January of each year. Included for the year of incorporation.

- Articles of

Incorporation.

- Certified translation to English of the Articles of Incorporation.

- Extract from the Public Registry with the registration information

and the current representatives of the corporation (serves as

certificate of incumbency, certificate of good standing and

certificate of incorporation).

- Certified translation to English of the Extract.

- Share certificates issued per your instructions.

- Legal Books.

- First Minutes of the Board in the Legal Books.

Sociedad

de Responsabilidad Limitada (Limited Liability Company)

The Sociedad de Responsabilidad Limitada (L.T.D.A. or L.L.C.) was

created as an alternative to the Sociedad Anónima (S.A.) (described

below). It is simpler to operate than a S.A. since it does not require

many formal acts to function. This makes it suitable for small business

enterprises. The main characteristics of the limited liability company

are, that the liability of the shareholders is limited to the amount

of their capital contribution, the capital is divided into individual

registered quotes which cannot be sold to the public unless previously

offered to other partners (first right of refusal), the company is

made up of a minimum of two quote holders with no limit as to the

maximum number of shareholders allowed.

This kind of corporation is managed by one or several MANAGERS who

may or may not be shareholders. While the simplicity of the operation

is a benefit of this form of incorporation the draw back is the limitation

on the ability to transfer ownership of the LTDA to third parties.

The LTDA can be handled by a manager with broad powers of attorney.

There can also be more managers or vice-managers, as deemed appropriate

by the owners.

|

|

|

Sociedad

Anonima

In Costa Rica the Sociedad Anónima is the most common used

corporation form of business organization. The main features are that

the liability of the shareholders is limited to their capital contribution

and stock ownership in the corporation is easily transferred to third

parties (endorsement of shares).

The Board of Directors is the supreme organ of the corporation and

it expresses the collective disposition of the partners. The following

positions should be assigned in the Board of Directors of the company:

1. President

2. Secretary

3. Treasurer

Additionally, a Controller (which cannot be family related with any

other Board Member) and a Resident Attorney or Agent has to be designated.

The Resident Attorney or Agent must be an Attorney at Law in Costa

Rica. In general, the positions outlined above are the minimum necessary

for incorporation purposes and do not exclude the possibility of appointing

vice-presidents, managers and others. Moreover, your disposition concerning

which member(s) of the Board of Directors will have Powers of Attorney

in the company and if those powers will be exercised jointly or separately

(at least the President has to have powers to represent the company,

both in court and out of court) is necessary.

Incorporation

Requisites:

In order to incorporate either of these types of companies, we will

require the following information of at least two founding partners:

1. Full name

2. Marital Status

3. Occupation

4. Street address

5. Passport number (copy of the passport of each person involved in the corporation)

Powers of Attorney:

In Costa Rica, there are various types of Powers of Attorney, among

them and the most commonly used are Full, General and Special, all of

which can be limited in kind, in time and in amount; and are summarized

as follows:

1. Full Power of Attorney: allows purchase, sale, mortgage, etc. of

any goods that the corporation may have. It also empowers to sign checks,

pay invoices, contract with suppliers, etc. It can be limited, both

in the type of acts that are permitted and prohibited, as well as in

total amount of each of the acts or contracts.

2. General Power of Attorney: is solely intended to be used for administrative

purposes, such as contracting of personnel for business purposes, signing

invoices and, in general, any other document which is strictly related

to the company's scope of activity.

3. Special Power of Attorney: entitles the representative to execute

one or more specific acts, whether of administration or disposition.

One special characteristic of this power of attorney is that, as opposed

to the two previously explained powers of attorney, it does not need

to be recorded in the Mercantile Section of the Public Registry.

Using the above mentioned guidelines, powers of attorney may be drafted

to fit special corporate needs. For instance, you may have the following

scenarios:

a. President holds full powers of attorney.

b. President and Secretary hold full powers of attorney so long as they

act jointly.

c. President and Secretary hold full powers of attorney acting individually

for transactions up to $ 50,000.00 and jointly thereafter.

d. All Board Members hold full powers of attorney.

e. Any other combination established by the Shareholders. |

|